What is the stock market?

Accounting and Finance academic Pavan Chakravarthula explains what the stock market is, how it works, and why it matters for both companies and investors.

What is the stock market?

In simple terms stock market is a place to buy and sell shares and other financial instruments of various publicly traded companies. Similar to buying fruits and vegetables online through delivery apps, stocks also can be bought and sold online through trading platforms. Companies like Google, Microsoft, Tesco and more, mobilise the required capital to run their businesses through financial instruments such as ordinary shares, preference shares, debentures, and bonds. They issue these instruments to various investors who pay money to buy shares and other instruments.

The stock market is a platform that connects companies with investors.

- For companies: It’s a way to raise capital by offering ownership (shares) to investors.

- For investors: It’s an opportunity to earn returns through price appreciation and dividends.

Major stock exchanges in the world include the London Stock Exchange (LSE), the New York Stock Exchange (NYSE), National Stock Exchange of India (NSE). These exchanges regulate various stock markets and reflect economic trends, investor sentiment and corporate performance.

The basics of stocks

A stock represents a fractional ownership in a company. When you buy a share, you become a shareholder entitled to a portion of the company’s profits and, in some cases, voting rights on company matters.

For example, if the total number of shares in a corporation is 1,000 and Mr. John Doe owns 50 shares of the corporation. This means, he owns 5% of the corporation. [(50 / 1000 shares)*100]

There are two main types of stocks:

- Common stocks: Offer voting rights and potential dividends.

- Preferred stocks: Typically offer fixed dividends but limited voting rights.

Stock prices fluctuate based on the company’s performance, economic indicators, market sentiments and global events.

- Start small: Use virtual trading platforms to practice without risk.

- Read widely: Books like The Intelligent Investor by Benjamin Graham or A Random Walk Down Wall Street by Burton Malkiel are great starting points.

- Stay curious: Follow market trends, attend webinars, and engage with financial communities.

- Ask questions: At BCU, our lecturers and tutors are here to guide you -don’t hesitate to reach out.

- Think long-term: Investing is a marathon, not a sprint. Focus on building knowledge and discipline.

Learning more through BCU’s Accounting and Finance course

Our Accounting and Finance programmes at undergraduate and postgraduate levels offer modules that directly link to stock market knowledge:

- Financial Markets and Institutions

- Investment Analysis

- Corporate Financial Strategies

- Quantitative Methods for Finance

Students gain hands-on experience with Bloomberg terminals, engage in simulated trading environments, and explore real-world case studies. This practical exposure is invaluable for careers in investment banking, asset management, and financial consultancy.

How the Stock Market Works

When people refer to the stock market, they often refer to a specific exchange, like the New York Stock Exchange. However, the stock market is made up of a larger system of exchanges, brokerages, and over-the-counter markets: Anywhere you can buy part of a company is part of the stock market.

In this vast, complex network of trading activities, shares of companies are bought and sold, protected by laws against fraud and other unfair trading practices. The stock market plays a crucial role in modern economies by enabling money to move between investors and companies.

People purchase stocks for a variety of reasons. Some hold onto shares to gain income from dividends. Others look for low-priced stocks likely to gain value, intending to sell at a profit. Still, others might be interested in having a say in how particular companies are run. A company’s stock, traditionally, most Class A shares, though not universal, allows investors to vote based on the number of shares they own at shareholder meetings.

Owning shares gives you the right to part of the company’s profits, often paid as dividends, and sometimes the right to vote on company matters.

Sometimes the best way to see how something works is to look at its parts. In that light, let’s review the major elements of the stock market, from the companies selling shares to stocks to exchanges to the indexes that give us a snapshot of the stock market’s health.

What Are Public Companies?

Not all companies can offer stock to the general public. In the U.S., only companies that are registered with the SEC can sell their shares on a public exchange like the NYSE or Nasdaq. These companies must meet stringent regulations and financial disclosure laws.1

The traditional route to going public is via an initial public offering (IPO). In the 2020s, special purpose acquisition companies (SPACs) have emerged as an alternative route for going public.

The primary market consists of those who buy their shares directly from the company, such as early investors, company insiders, and, for companies going public, financial underwriters. It also includes private placements, where a company sells its shares directly to investors without going through the registration process.

Stocks: Buying and Selling Shares

When you buy a stock or a share, you’re getting a piece of that company. How much of the company you own depends on the number of shares the company has issued and the number of shares you own.

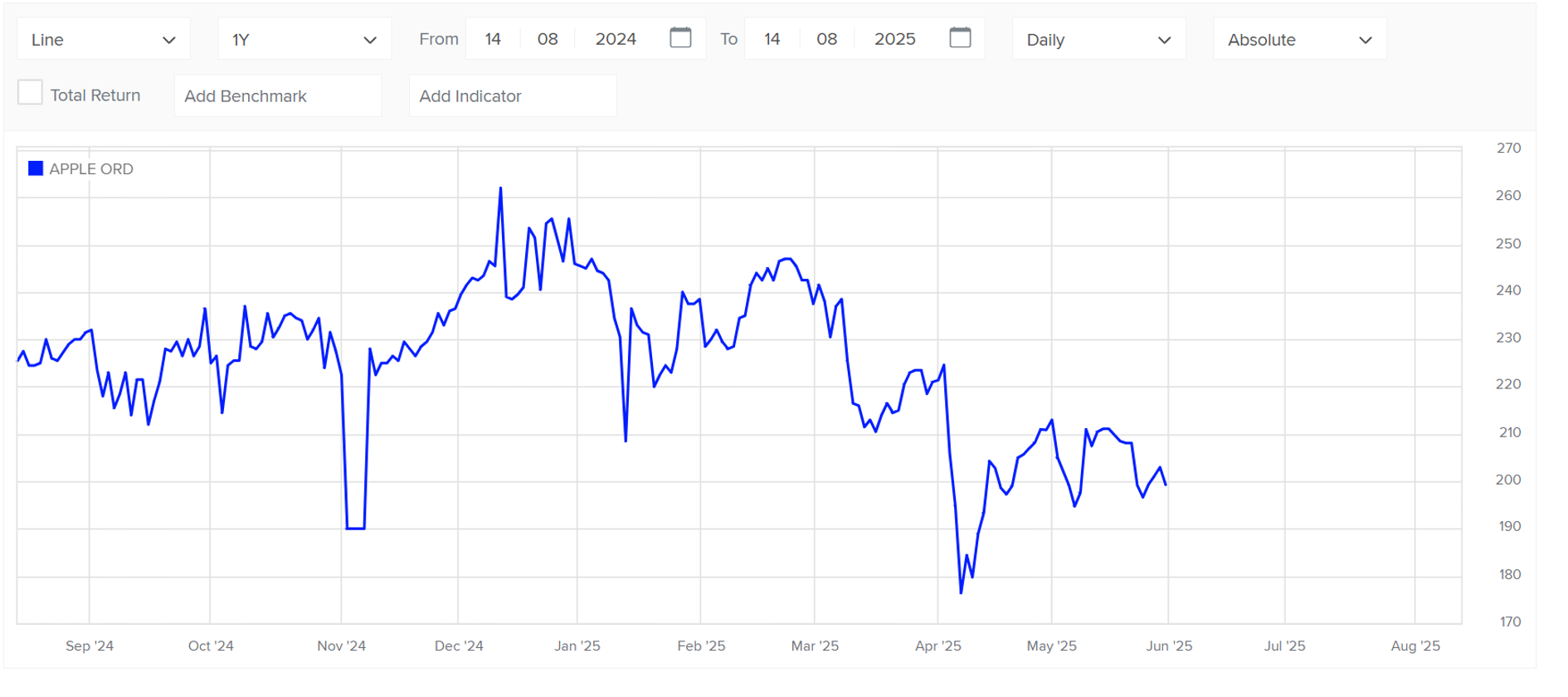

If it’s a small, private company, a single share could represent a large part of the company. Major public companies often have millions, even billions, of shares. For example, Apple Inc. (AAPL) has billions of shares in circulation, so a single share is just a tiny fraction of the company.

The price of a stock changes based on the demand for shares from new investors who want to buy, or the supply of shares from existing investors who want to sell. Not every investor makes decisions based on the same criteria, and what might seem like a high price to one investor is a bargain to another. This dynamic keeps shares trading hands and makes future prices difficult to predict.

What Is a Stock Exchange?

Once a company goes public, its shares can be traded freely on the stock market. This means that investors can buy and sell shares among themselves. Most trading occurs on stock exchanges, although there are other venues.

Stock exchanges are organized and regulated “places” (today it’s mostly virtual) where stocks and other securities are bought and sold. They play a crucial role in the financial system by providing a platform for companies to raise money by selling their stocks and bonds to the public.

The NYSE and Nasdaq are prime examples, serving as central locations for buying and selling stocks. There are many other major exchanges worldwide, such as the London Stock Exchange, the Tokyo Stock Exchange, and the Shanghai Stock Exchange.

Each exchange has its own internal rules, and investors follow different national and local laws. These are meant to ensure fair trading practices and to keep investors confident in dealing there. They also provide transparency in the trading process, giving real-time information on securities prices.

A major benefit of trading on stock exchanges is liquidity, the ability to buy or sell stocks relatively easily. With thousands of buyers and sellers, there is always someone willing to buy or sell shares for the right price.

Many stock exchanges cross-list company shares, offering securities listed on other exchanges. This allows companies to reach more investors when raising capital, and gives investors a wider range of trading options.